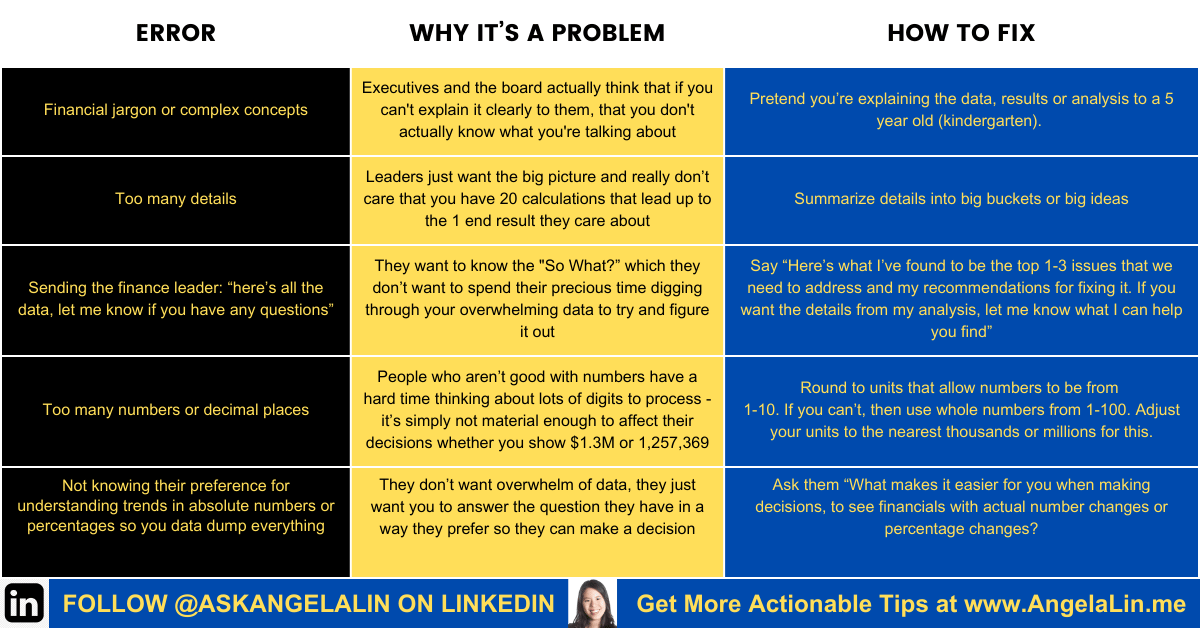

Ever felt like your financial explanations hit a brick wall with non-finance leaders? Let's break down the barriers with 5 easy fixes to elevate your communication game and drive meaningful impact:

Error #1: Too much financial jargon or complex concepts

Why it's a Problem: Executives and the board actually think that if you can't explain it clearly to them, that you don't actually know what you're talking about.

Fix: Pretend you’re explaining the data, results or analysis to a 5 year old (kindergarten). Examples:

+ Use “costs required for equipment/buildings based on how long you can use it for” instead of depreciation

+ Use “what you own” for assets and “what you owe” or “what you need to pay back” for liabilities

Error #2: Too many details

Why it's a Problem: Leaders just want the big picture and really don’t care that you have 20 calculations that lead up to the 1 end result they care about.

Fix: Summarize details into big buckets or big ideas

Example: Payroll went up by 20% because we had additional people hired to backfill sick calls (instead of “overtime for our 15 part time people went up by 30% to cover our 10 full time people being sick, along with higher benefits that we’re paying for our admin staff)

Error #3: Sending the finance leader: “here’s all the data, let me know if you have any questions”

Why it’s a Problem: They want to know the "So What?” which they don’t want to spend their precious time digging through your overwhelming data to try and figure it out.

Fix: Say “Here’s what I’ve found to be the top 1-3 issues that we need to address and my recommendations for fixing it. If you want the details from my analysis, let me know what I can help you find”

Error #4: Too many numbers or decimal places

Why it’s a Problem: People who aren’t good with numbers have a hard time thinking about lots of digits to process - it’s not material enough to affect their decisions whether you show $1.3M or 1,257,369

Fix: Try your best to round to things that can be talked about from 1-10 (without decimals). If you can’t, then use whole numbers from 1-100. Adjust your units to the nearest thousands or millions for this.

Error#5: Not knowing their preference for understanding trends in absolute numbers or percentages so you data dump everything

Why it’s a Problem: executives and the board don’t want data overwhelm, they just want you to answer the question in a way they prefer so they can make a decision.

Fix: Ask them “what makes it easier for you when making decisions, to see financials with actual number changes or percentage changes? Or only highlight the ones that have a certain number and % change?” They’ll appreciate it since you’re personalizing it for them to add value (which most finance people don’t do)

Ready to transform your finance communication? Dive into these practical fixes and start seeing immediate results! 💡

Do you agree or disagree? What would you add?

Reshare if you agree and found this helpful